How can AI prevent fraudulent transactions in real time?

How can AI prevent fraudulent transactions in real time?

by Maximilian 03:16pm Jan 30, 2025

Preventing fraudulent transactions in real-time means using AI systems to detect and block potentially unauthorized or malicious activities as they occur, rather than after the fact. This ensures that fraudulent transactions are stopped before any financial loss or security breach can take place.

AI can prevent fraudulent transactions in real time by leveraging advanced techniques to detect and respond to suspicious activities as they occur. Here's how AI achieves this:

1. Behavioral Pattern Recognition

AI analyzes and learns normal user behavior to detect anomalies that could indicate fraud:

Transaction Patterns: AI examines purchase history, transaction frequency, and typical spending amounts. Unusual deviations (e.g., a sudden large purchase in a foreign country) trigger alerts.

Behavioral Biometrics: AI monitors how users interact with devices (e.g., typing speed, touch patterns) to identify inconsistencies that suggest unauthorized access.

2. Machine Learning (ML) Models

Supervised Learning: AI models are trained on historical data with labeled fraudulent and legitimate transactions. This enables them to identify known fraud patterns.

Unsupervised Learning: Clustering and anomaly detection methods uncover new or emerging fraud tactics by identifying deviations from expected behavior without relying on labeled data.

Reinforcement Learning: These models dynamically adapt to evolving fraud strategies by learning from real-time feedback.

3. Real-Time Data Analysis

AI processes transaction data in milliseconds to flag or block suspicious activity:

Rule-Based Systems Enhanced with AI: AI refines pre-defined rules by prioritizing risk factors and minimizing false positives.

Streaming Analytics: AI analyzes data streams in real time to detect and act on fraudulent transactions as they happen.

4. Risk Scoring

AI assigns a risk score to every transaction based on multiple factors, including user location, device ID, transaction amount, and behavioral patterns.

High-risk transactions can be flagged for manual review or automatically declined.

5. Network Analysis

AI identifies connections between accounts, devices, and transactions to detect coordinated fraud:

Graph-Based Techniques: AI models map relationships between entities to uncover fraud rings or suspicious patterns of activity.

Shared Indicators: Identifying reused details (e.g., IP addresses, device fingerprints) across accounts helps detect organized fraud.

6. Integration with External Data Sources

Geolocation Data: AI verifies that a transaction aligns with the user's typical locations and flags outliers.

Blacklist Databases: AI cross-references transactions with known fraudulent accounts, devices, or IP addresses.

Dark Web Monitoring: AI scans for leaked credentials or credit card details and flags transactions linked to compromised accounts.

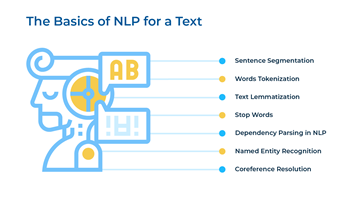

7. Natural Language Processing (NLP)

Chat and Email Scams: AI analyzes messages for phishing attempts, helping to prevent fraudulent transactions initiated via social engineering.

Customer Communication Monitoring: NLP identifies suspicious language in customer support interactions that might indicate account takeover attempts.

8. Continuous Model Updating

Adaptive Learning: AI models are updated with the latest fraud trends to stay ahead of fraudsters.

Global Insights: AI systems leverage data from multiple regions and industries to recognize emerging threats worldwide.

9. Multi-Factor Authentication (MFA)

AI strengthen security by combining real-time fraud detection with advanced authentication methods:

Dynamic Challenges: AI prompts users for additional verification when a transaction appears risky.

Context-Aware Authentication: AI evaluates transaction context (e.g., device trustworthiness, prior transaction history) to determine the need for MFA.

10. Automated Responses

Blocking Transactions: AI automatically blocks high-risk transactions, preventing fraud in real time.

User Alerts: AI sends instant notifications to users for suspicious activity, allowing them to confirm or deny the transaction.

Challenges and Innovations

False Positives: AI systems aim to reduce false alarms by fine-tuning models for accuracy.

Evolving Threats: AI continuously adapts to counteract increasingly sophisticated fraud tactics.

Scalability: AI solutions are designed to handle high transaction volumes without compromising speed or accuracy.

Conclusion

AI prevents fraudulent transactions in real time by analyzing behavioral patterns, leveraging machine learning, and integrating contextual data to detect and respond to threats instantly. These capabilities enhance security, reduce financial losses, and improve user trust in financial systems.