Assessing business adaptation to carbon offset and trading systems

Assessing business adaptation to carbon offset and trading systems

by vivienne 11:06am Jan 03, 2025

Assessing business adaptation to carbon offset and trading systems involves evaluating how companies are responding to and integrating carbon market mechanisms—such as carbon offset programs and emissions trading systems (ETS)—into their business strategies. This includes understanding the regulatory landscape, financial implications, and operational changes required to engage in these systems effectively.

Below are key areas to consider when assessing how businesses adapt to carbon offset and trading systems:

1. Regulatory Compliance and Understanding

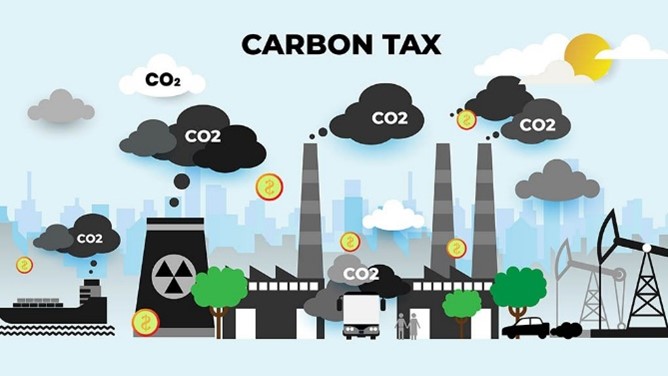

Compliance with National/Regional Emissions Regulations: Businesses must stay informed about the legal frameworks and regulations surrounding carbon emissions in their operating regions (e.g., EU Emissions Trading System, California Cap-and-Trade, or China's carbon market). Compliance is crucial for avoiding fines and ensuring eligibility to participate in carbon trading.

Carbon Offset Certification Standards: Companies must evaluate which carbon offset programs are credible, ensuring that the carbon credits they purchase or generate meet established standards like VCS (Verified Carbon Standard), Gold Standard, or the Clean Development Mechanism (CDM). Understanding the quality and credibility of offsets is vital to prevent greenwashing and ensure true environmental impact.

Carbon Accounting Practices: Businesses need to implement rigorous carbon accounting systems to accurately track and report emissions. This is essential for understanding their carbon footprint, determining their offset needs, and reporting to regulators or stakeholders.

2. Strategic Integration into Business Models

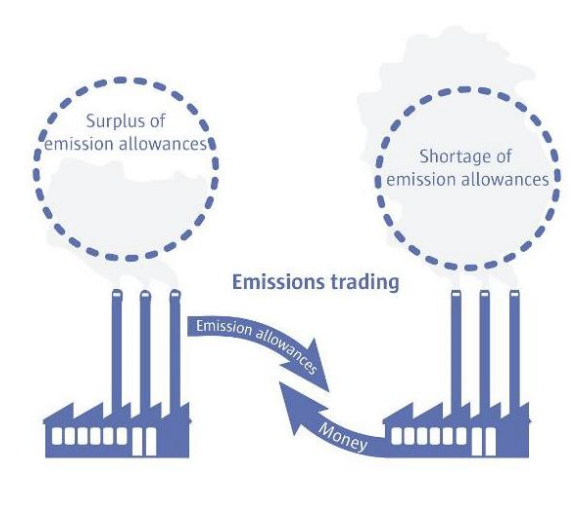

Carbon Offset Purchasing and Investment: Many companies use carbon offset programs as part of their strategy to mitigate their emissions, particularly when direct emissions reductions are not feasible. This could involve investing in renewable energy projects, forest conservation, or methane capture programs.

Incorporating Carbon Costs into Business Decisions: Companies must factor carbon costs into decision-making processes. This could involve adjusting pricing strategies, re-evaluating supply chain practices, or selecting lower-carbon materials and technologies to reduce the need for purchasing offsets or permits.

Developing Carbon-Neutral Goals: Many businesses are setting ambitious carbon neutrality goals that rely on both reducing emissions internally and offsetting remaining emissions through external projects. These goals often serve as a differentiator in competitive markets, appealing to environmentally conscious consumers.

3. Financial Considerations and Market Exposure

Cost Management: Engaging in carbon offset and trading systems comes with financial implications, including the cost of purchasing carbon credits or allowances. Companies must assess how these costs will affect their bottom line and potentially pass them on to consumers, or how to mitigate them through improved efficiencies or internal carbon reduction strategies.

Volatility and Risk Management: Carbon credit prices can fluctuate depending on market conditions and regulatory changes. Businesses must understand and manage the financial risks of participating in carbon trading markets. This could involve hedging strategies, diversification of offset types, or committing to long-term purchase agreements to stabilize costs.

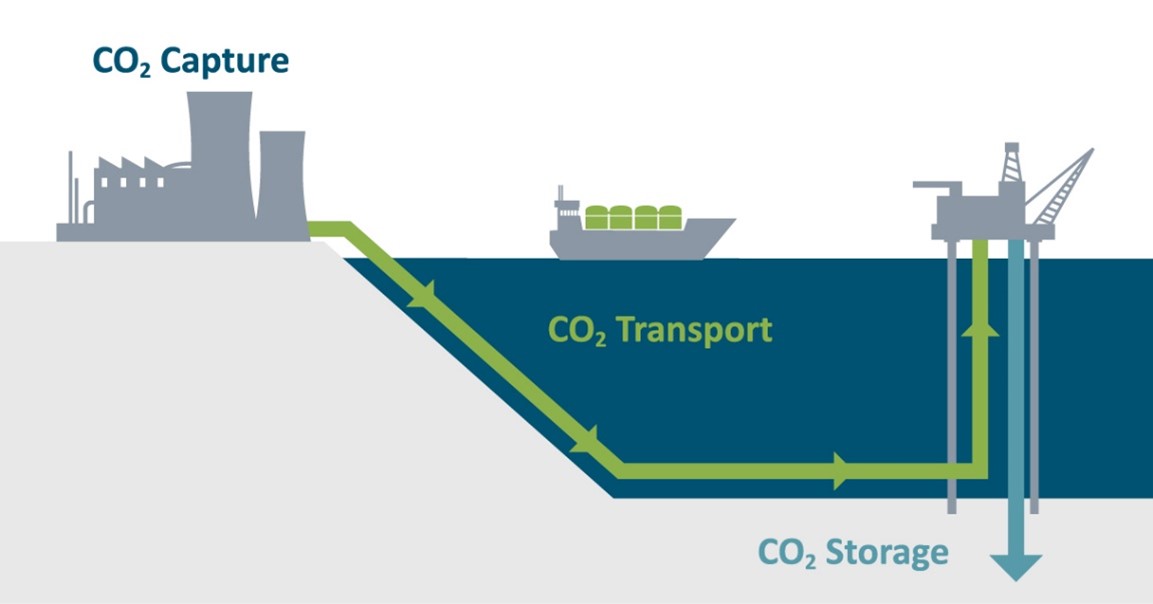

Investment in Internal Emission Reductions: Some businesses may opt to invest in internal emissions reductions (e.g., renewable energy adoption, energy efficiency improvements, or decarbonization technologies) to reduce reliance on carbon credits. This can be a more stable, long-term financial strategy.

4. Operational and Supply Chain Adjustments

Emissions Measurement and Reporting: Companies need robust systems in place to measure, report, and verify their emissions. This requires accurate tracking mechanisms and often involves engaging third-party auditors to ensure the credibility of emissions data.

Supply Chain Optimization: Carbon trading systems may incentivize businesses to work with suppliers who have lower carbon footprints or participate in emissions trading. This can lead to changes in sourcing decisions, such as switching to low-carbon or renewable materials, optimizing logistics to reduce transportation emissions, or working with suppliers who also engage in carbon offsetting.

Technology Adoption and Innovation: To reduce emissions and decrease the need for offsetting, businesses may invest in clean technologies, such as energy-efficient machinery, electrification, carbon capture, and storage solutions (CCS), or renewable energy systems. These technologies not only reduce reliance on external carbon markets but also enhance long-term sustainability.

5. Consumer and Stakeholder Expectations

Brand Image and Reputation: Businesses are increasingly expected to demonstrate their commitment to climate action. Participating in carbon offset programs and trading can bolster a company’s reputation, particularly among environmentally conscious consumers and investors. However, businesses must ensure their offsets represent real emissions reductions and are transparently communicated to avoid accusations of greenwashing.

Engagement with Investors: Institutional investors and shareholders are increasingly considering environmental, social, and governance (ESG) factors when making investment decisions. Companies that engage in carbon offsetting or carbon trading can attract ESG-focused investors by demonstrating their commitment to sustainability and risk management related to climate change.

Engagement with Customers: Many companies use carbon offsetting programs as a marketing tool to appeal to consumers who value sustainability. Offering carbon-neutral products or services or providing transparency about the company's carbon footprint can enhance brand loyalty.

6. Technology and Innovation in Carbon Markets

Blockchain and Transparency: As blockchain technology matures, it is being explored for increasing transparency in carbon offset and trading systems. Blockchain can ensure that carbon credits are not double-counted and that transactions are traceable and verifiable. Businesses that embrace such technologies may gain a competitive edge in credibility and accountability.

Carbon Management Platforms: Businesses may adopt advanced carbon management platforms and software that help automate the tracking, trading, and reporting of carbon credits, improving efficiency and accuracy in carbon accounting. These platforms can assist in decision-making and optimize a company’s engagement with carbon markets.

7. Long-Term Business Sustainability and Adaptation

Transition to a Low-Carbon Economy: Companies that adapt early to carbon offset and trading systems are better positioned for long-term resilience in a low-carbon economy. This includes anticipating future regulations, preparing for potential carbon taxes, and adapting business models to align with sustainability trends.

Scalability of Adaptation: The scalability of carbon offset and trading systems needs to be assessed. Can a company scale its carbon offset efforts as it grows, or will it need to continuously invest in more credits or offsets as emissions increase? This could affect how businesses plan for long-term sustainability and cost management.

Conclusion

Successful adaptation to carbon offset and trading systems requires businesses to assess both the operational and financial impacts, aligning strategies with global sustainability goals. By integrating carbon markets into business models, companies can reduce their carbon footprint, manage emissions risks, and meet regulatory requirements, all while improving their competitive position in an increasingly eco-conscious market. The ability to adapt effectively will depend on a company’s readiness to invest in carbon measurement tools, reduce emissions internally, and strategically engage in carbon trading or offset markets.