How does income inequality contribute to financial instability?

How does income inequality contribute to financial instability?

by Maximilian 10:04am Jan 04, 2025

Income inequality can significantly contribute to financial instability through various economic, social, and political mechanisms. Here's an exploration of the key pathways:

1. Reduced Aggregate Demand

Limited Consumption by Lower-Income Groups: Lower-income households tend to spend a higher proportion of their income on consumption. When income concentrates in higher-income groups, overall consumption may decline because wealthier individuals save more relative to their income.

Economic Slowdown: A decline in aggregate demand can lead to slower economic growth, reduced business revenues, and increased unemployment, creating conditions for financial instability.

2. Over-Reliance on Credit

Debt-Fueled Consumption: To maintain living standards amidst stagnating wages, lower- and middle-income groups may rely heavily on borrowing, leading to rising household debt levels.

Increased Default Risks: High levels of debt increase the likelihood of loan defaults during economic downturns, threatening the stability of financial institutions.

Asset Bubbles: Excessive borrowing can fuel speculative investments, leading to asset price bubbles that may burst and destabilize financial markets.

3. Asset Price Volatility

Concentration of Wealth in Financial Assets: Wealthier individuals are more likely to invest in financial markets, increasing the concentration of wealth in these volatile assets.

Market Speculation: Greater inequality can amplify speculative activities, as wealthy investors seek high returns, leading to increased volatility and the risk of financial crises.

4. Erosion of Social Cohesion

Political and Social Unrest: Income inequality can exacerbate tensions and lead to protests or instability, undermining investor confidence and economic stability.

Populist Policies: High inequality may drive demand for populist economic policies, such as protectionism or unsustainable fiscal measures, which can destabilize markets.

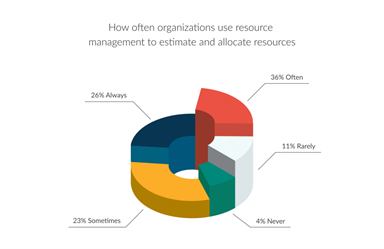

5. Inefficient Resource Allocation

Underinvestment in Human Capital: Inequality often results in unequal access to education, healthcare, and opportunities, reducing workforce productivity and economic resilience.

Skewed Investment Patterns: Wealth concentration can lead to investments favoring luxury goods or speculative assets rather than broad-based economic development.

6. Weakening of Financial Institutions

Banking Crises: High inequality can lead to unsustainable lending practices as banks try to meet the demand for credit from low-income households.

Systemic Risks: The financial sector may become more vulnerable to systemic shocks if a large portion of the population is financially precarious.

7. Fiscal Constraints

Tax Base Erosion: Inequality can reduce the overall tax base as wealthier individuals and corporations often employ tax avoidance strategies.

Higher Social Spending: Governments may need to increase spending on social programs to address inequality, potentially leading to fiscal imbalances.

8. Global Implications

Trade Imbalances: Inequality within and across countries can lead to trade imbalances, as countries with high inequality may over-rely on exports while others accumulate unsustainable debts.

Cross-Border Capital Flows: Wealth concentration can drive speculative cross-border capital flows, increasing vulnerability to global financial shocks.

Policy Solutions

To mitigate the financial instability arising from income inequality:

Progressive Taxation: Implement tax systems that redistribute wealth more effectively.

Social Safety Nets: Strengthen unemployment benefits, healthcare access, and education funding.

Financial Regulation: Enforce responsible lending practices and prevent speculative excesses.

Wage Growth Policies: Support policies that encourage fair wages, such as minimum wage increases and labor union empowerment.

Inclusive Growth Strategies: Promote investments in sectors that create broad-based economic opportunities.