What financing mechanisms can be used to support global climate action?

What financing mechanisms can be used to support global climate action?

by Maximilian 11:28am Jan 04, 2025

Supporting global climate action requires diverse financing mechanisms that mobilize resources from public, private, and multilateral sources. Below are the key mechanisms:

1. Public Financing Mechanisms

Government Budgets: Governments can allocate funds to climate adaptation, mitigation projects, and research.

Green Bonds: Governments issue bonds specifically for funding renewable energy, sustainable transport, or climate-resilient infrastructure.

Carbon Taxes: Taxing carbon emissions generates revenue that can be reinvested in green projects.

Subsidies and Incentives: Public funds can support renewable energy adoption, energy efficiency, and sustainable practices.

2. Multilateral and International Climate Funds

Green Climate Fund (GCF): Provides financial support to developing countries for climate adaptation and mitigation projects.

Global Environment Facility (GEF): Funds projects in biodiversity conservation, climate change, and pollution management.

Adaptation Fund: Supports climate adaptation efforts, particularly in vulnerable regions.

Climate Investment Funds (CIFs): Offers financing for renewable energy, resilience, and energy efficiency in developing countries.

Multilateral Development Banks (MDBs): Institutions like the World Bank and Asian Development Bank provide loans, grants, and technical assistance.

3. Private Sector Financing

Impact Investments: Private investors fund projects that deliver measurable environmental and social benefits alongside financial returns.

Green Banks: Financial institutions dedicated to funding renewable energy and energy efficiency projects.

Corporate Social Responsibility (CSR): Companies allocate funds for sustainable initiatives as part of their CSR commitments.

Sustainable Debt Instruments: Companies issue green, blue, or sustainability-linked bonds to finance climate-related activities.

4. Market-Based Mechanisms

Carbon Trading: Cap-and-trade systems allow companies to buy and sell carbon credits, creating financial incentives to reduce emissions.

Payment for Ecosystem Services (PES): Entities pay for the preservation or restoration of ecosystems that provide climate benefits, such as forests.

Offset Mechanisms: Companies or individuals fund projects that offset their carbon footprint, such as reforestation or renewable energy initiatives.

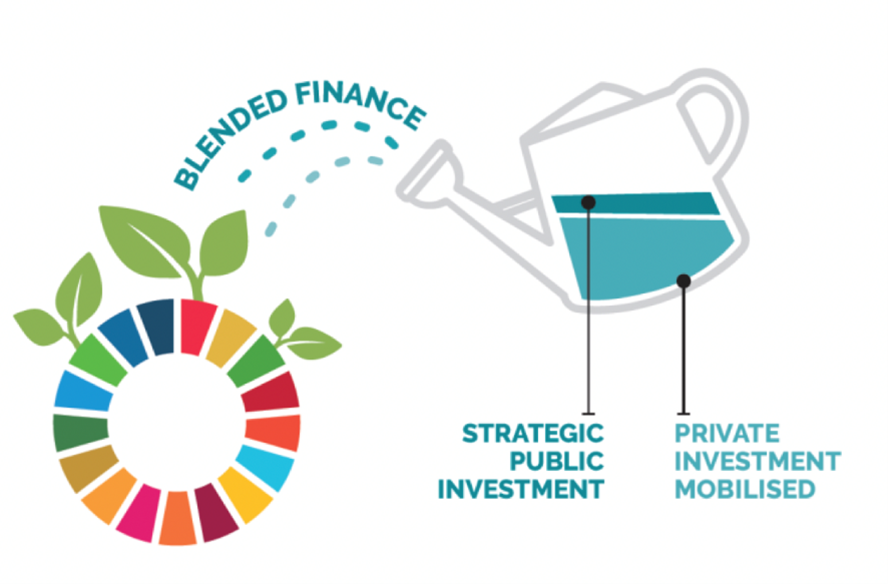

5. Blended Finance

Blended finance combines public and private resources to reduce investment risks and attract private capital for climate action:

Public-Private Partnerships (PPPs): Governments and private firms co-finance sustainable projects.

Concessional Loans: Public entities provide loans at below-market rates to make green projects financially viable.

6. Insurance and Risk Management

Climate Risk Insurance: Helps vulnerable countries recover from climate-induced disasters, reducing financial strain.

Catastrophe Bonds (Cat Bonds): Bonds that pay out to governments or organizations in the event of natural disasters.

7. Technology and Innovation Financing

Research Grants: Governments and multilateral agencies fund research into green technologies.

Venture Capital: Private investors finance startups developing climate-friendly technologies.

Technology Transfer Funds: Facilitate the transfer of green technologies to developing countries.

8. Community and Grassroots Financing

Microfinance: Provides small loans to individuals or communities for adopting sustainable practices, such as solar home systems or water-efficient farming.

Crowdfunding: Engages the public in funding specific climate initiatives through online platforms.

9. International Policy Instruments

Paris Agreement Commitments: Developed countries have pledged to mobilize $100 billion annually to support climate action in developing nations.

Debt-for-Nature Swaps: Countries reduce external debt in exchange for committing to environmental conservation efforts.

Trade Policies: Preferential trade terms for sustainable products can indirectly support climate financing.

10. Local and Regional Mechanisms

City-Level Green Bonds: Municipalities issue bonds to fund urban sustainability projects, like public transport and energy-efficient buildings.

Regional Development Banks: Provide targeted financing for regional climate projects.

Challenges and Solutions

Challenges:

Limited access to finance in low-income countries.

High perceived risk in investing in developing regions.

Fragmentation of climate financing initiatives.

Solutions:

Establish frameworks to de-risk investments (e.g., guarantees, insurance).

Improve transparency and accountability in fund allocation.

Strengthen capacity-building efforts to enable countries to access funds effectively.