Integration of cryptocurrencies and NFTs

Integration of cryptocurrencies and NFTs

by Maximilian 03:18pm Jan 09, 2025

The integration of cryptocurrencies and non-fungible tokens (NFTs) has significantly transformed the digital economy, fostering innovation across various sectors such as art, gaming, real estate, and more. Here's an overview of how these two technologies are interconnected and their implications:

1. Cryptocurrencies as the Backbone of NFTs

Payment and Transactions: Cryptocurrencies, primarily Ethereum, serve as the primary means of payment for minting, buying, and selling NFTs. Gas fees for transactions on blockchain networks are paid in native cryptocurrencies.

Smart Contracts: NFTs are created and managed through smart contracts on blockchain networks. These smart contracts, written on platforms like Ethereum, Binance Smart Chain, or Solana, rely on cryptocurrencies for execution.

2. NFTs Enhancing Cryptocurrency Utility

Adoption and Awareness: The rise of NFTs has introduced a broader audience to cryptocurrencies, as users must often acquire crypto to engage in NFT marketplaces.

Use Cases Expansion: NFTs extend the utility of cryptocurrencies beyond financial transactions into domains like art ownership, virtual goods, and ticketing.

3. Use Cases of Integration

Digital Art and Collectibles: Artists mint NFTs representing their work, selling them for cryptocurrencies. Buyers gain verified ownership, and creators can earn royalties via smart contracts.

Gaming: Blockchain-based games integrate NFTs as in-game assets (e.g., weapons, characters, skins), purchased or traded using cryptocurrencies.

Metaverse and Virtual Real Estate: Virtual worlds like Decentraland or The Sandbox allow users to buy, sell, and build on virtual land represented as NFTs, with cryptocurrencies as the medium of exchange.

Tokenized Assets: Physical assets (e.g., real estate, rare collectibles) are tokenized as NFTs, enabling fractional ownership and trade using cryptocurrencies.

4. Challenges in Integration

High Transaction Costs: On popular networks like Ethereum, gas fees can be prohibitive, especially during network congestion.

Environmental Concerns: Proof-of-work blockchains, historically dominant in NFTs, consume significant energy. Transitioning to proof-of-stake (e.g., Ethereum 2.0) mitigates this.

Scalability: The demand for NFT transactions strains blockchain networks, leading to scalability challenges.

Regulation: Unclear regulatory frameworks for cryptocurrencies and NFTs can deter potential users and investors.

5. Future Directions

Cross-Chain Solutions: Technologies enabling NFTs to operate across multiple blockchain networks are being developed, increasing accessibility and reducing costs.

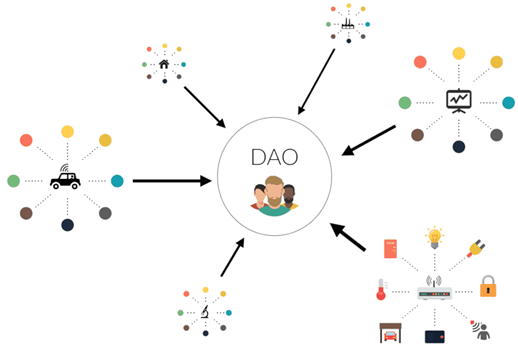

Decentralized Finance (DeFi) and NFTs: NFTs are increasingly integrated into DeFi ecosystems, enabling their use as collateral for loans or fractional ownership through tokenization.

Mainstream Adoption: As blockchain technologies mature and become more user-friendly, NFTs and cryptocurrencies are likely to gain wider acceptance in industries like entertainment, education, and real estate.

The integration of cryptocurrencies and NFTs represents a paradigm shift in how value is created, owned, and transferred in the digital age. While challenges remain, ongoing innovation continues to expand the possibilities for these technologies.