How to evaluate the potential of P2E games as an investor

How to evaluate the potential of P2E games as an investor

by Maximilian 03:19pm Jan 14, 2025

Evaluating the potential of Play-to-Earn (P2E) games as an investor requires a thorough analysis of several factors, including the game’s economy, technology, player engagement, and overall market trends. Here’s a comprehensive guide to help investors assess the viability and potential of P2E games:

1. Game Design and Mechanics

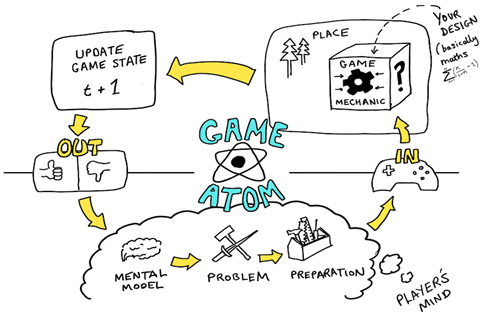

Gameplay Quality: Evaluate the game’s overall design, mechanics, and user experience (UX). A successful P2E game should offer compelling and enjoyable gameplay that motivates players to invest time and money. Games with clear progression systems, fun gameplay loops, and strategic depth will tend to have a higher retention rate and longer player engagement.

Economic Model: Analyze the in-game economy, including how players can earn, spend, and trade digital assets. Look for:

Sustainability: A balanced economy that rewards players without inflating token values or depleting resources too quickly.

Earning Mechanisms: Understand the P2E mechanics (e.g., NFTs, staking, rewards, virtual goods) and whether they offer fair, diverse earning opportunities.

Tokenomics: Assess the game’s cryptocurrency or token structure (e.g., utility tokens, governance tokens) and how tokens are minted, distributed, and used within the game. A transparent and well-thought-out tokenomics model is crucial for long-term sustainability.

2. Team and Development Track Record

Development Team: Investigate the background and experience of the development team. Are they experienced in game design, blockchain technology, or other relevant fields? Have they previously worked on successful gaming projects or blockchain applications?

Partnerships and Advisors: Strong backing from reputable investors, gaming studios, or blockchain platforms can indicate a higher likelihood of success. Check for partnerships with industry leaders, established game publishers, or other major stakeholders.

3. Blockchain and Smart Contracts

Blockchain Platform: Determine which blockchain the game is built on. Popular blockchains like Ethereum, Binance Smart Chain, and Solana have proven scalability, security, and liquidity. However, newer or niche blockchains may offer faster transactions and lower fees, which can be beneficial for P2E gameplay.

Smart Contract Security: Smart contracts power most P2E games, especially for managing digital assets (like NFTs) and rewarding players. Ensure that smart contracts have been audited by a reputable third-party firm to minimize the risk of vulnerabilities or hacks.

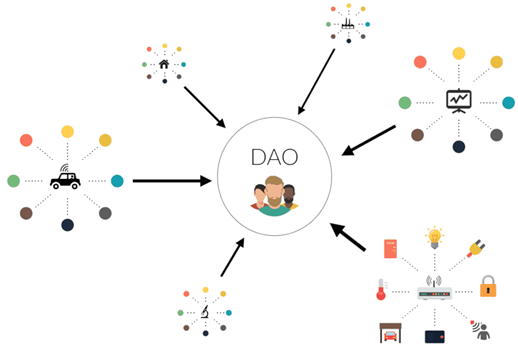

Decentralization and Ownership: Assess how much control the game gives to players in terms of asset ownership (e.g., NFTs, tokens). Games that offer true ownership of digital assets (verified through blockchain) generally attract more players and investors.

4. Player Base and Community Engagement

Active Player Base: A large and active player base is a key indicator of a P2E game's success. Check metrics such as daily active users (DAUs), monthly active users (MAUs), and overall engagement (time spent in-game, in-game purchases, etc.).

Community Engagement: A thriving, engaged community can be a strong signal of a game's long-term potential. Look at the size and activity level of communities on platforms like Discord, Telegram, Twitter, and Reddit. Active discussions, feedback loops, and community-driven content are indicators of strong player interest and loyalty.

User Retention: Evaluate the game's ability to retain players over time. High churn rates may indicate issues with gameplay, rewards, or the overall player experience. Games with strong engagement and player retention generally offer more long-term profitability for investors.

5. Monetization and Revenue Generation

Revenue Model: Investigate how the game generates revenue and how this is shared with players. Common revenue models for P2E games include:

In-game purchases (skins, items, land, etc.)

Transaction fees (from buying/selling NFTs)

Advertising or sponsorships

Play-to-earn rewards and staking mechanisms

Scalability of Earnings: Determine if the game’s earning model is scalable. Games that offer consistent earning potential for a wide range of players will tend to retain a more diverse player base, which can drive more revenue.

Incentives for Long-Term Investment: Check if the game offers long-term incentives for players to keep earning and reinvesting in the ecosystem, such as staking, holding NFTs, or participating in governance.

6. Technology and Innovation

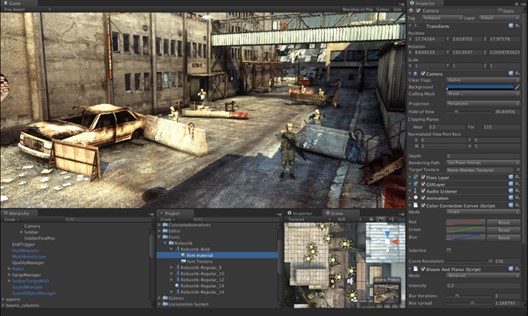

Game Engine and Graphics: Evaluate the quality of the game’s engine, graphics, and overall technical performance. A smooth, high-quality gaming experience is essential to attracting players and investors. Pay attention to whether the game runs well across different platforms (PC, mobile, consoles, etc.).

AR/VR/AI Integration: Investigate whether the game is integrating emerging technologies like AR, VR, or AI. These technologies can provide unique gameplay experiences and may contribute to higher player engagement and value for in-game assets.

Interoperability: Consider whether the game’s assets (NFTs, tokens, characters, items) are interoperable across other platforms or games. Interoperability can significantly increase the utility and demand for digital assets, adding value to your investment.

7. Market Trends and Competition

Growth of the P2E Market: Assess the overall growth potential of the P2E market. The sector is expanding rapidly, but it is also highly competitive. Look at trends in blockchain gaming, NFT adoption, and general gaming culture. How popular is the P2E genre in the current market, and how might it evolve in the future?

Competitive Landscape: Evaluate the competition within the P2E space. Are there other games with similar mechanics or larger player bases? How does the game you are considering stand out? A unique selling proposition (USP), whether in gameplay, rewards structure, or technology, is important for long-term success.

Regulatory Environment: Keep an eye on any regulatory challenges that may impact the game or blockchain gaming in general. Governments around the world are starting to address issues like taxation, gaming laws, and cryptocurrency regulations, and changes in these areas could influence the market’s growth potential.

Conclusion:

Investing in P2E games requires a holistic approach that includes evaluating the game’s economy, technology, player engagement, and competitive landscape. By carefully analyzing these factors, you can identify games that have the potential for long-term growth, sustainability, and profitability. As the P2E space is still relatively new, it’s essential to stay informed about emerging trends, market shifts, and technological innovations to make informed investment decisions.