Success stories and cautionary tales

Success stories and cautionary tales

by Maximilian 04:23pm Jan 14, 2025

Success stories and cautionary tales are real-life examples that highlight both the positive and negative outcomes in a specific context, such as investing, business, or personal decisions. They serve as learning tools by showcasing what led to success and what caused failure.

1. Axie Infinity (AXS, SLP) – The Pioneer of P2E Success

Overview:

Launched in 2018 by Sky Mavis, Axie Infinity became a global phenomenon in 2021, introducing millions to the P2E model. Players breed, battle, and trade fantasy creatures called Axies, earning Smooth Love Potion (SLP) and Axie Infinity Shards (AXS) tokens.

Success Factors:

First-Mover Advantage: Dominated the early P2E market with a user-friendly ecosystem.

Strong Community Growth: Exploded in the Philippines and other developing countries as a source of income.

NFT Ownership: Axie NFTs allowed players to earn, trade, and invest.

Strategic Partnerships: Secured $152 million in Series B funding from prominent investors like Andreessen Horowitz.

Investment Reward:

AXS token surged from ~$0.50 in late 2020 to an all-time high of ~$165 in November 2021.

Axie NFT prices soared, with some selling for tens of thousands of dollars.

2. The Sandbox (SAND) – Virtual Real Estate Goldmine

Overview:

The Sandbox is a decentralized metaverse platform where users create, own, and monetize virtual experiences using NFTs and the native SAND token.

Success Factors:

High-Profile Partnerships: Collaborations with Adidas, Atari, and Snoop Dogg increased credibility.

Land Ownership Model: Virtual real estate became a speculative and utility-driven asset.

Metaverse Trend Alignment: Capitalized on the booming interest in virtual worlds.

Investment Reward:

SAND token grew from ~$0.05 in early 2020 to over $8 in late 2021.

Virtual land parcels sold for millions, with one plot selling for $4.3 million.

3. Gala Games (GALA) – Building a Decentralized Gaming Ecosystem

Overview:

Gala Games focuses on developing a network of blockchain-based games where players own in-game assets. Their flagship game, Town Star, exemplifies the P2E model.

Success Factors:

Ecosystem Approach: Multiple games under one umbrella reduce reliance on a single title.

Player Ownership: Emphasis on decentralized control and player governance.

Strategic Growth: Partnerships with well-known developers and brands.

Investment Reward:

GALA token skyrocketed from ~$0.001 in January 2021 to ~$0.70 in late 2021.

Cautionary Tales in P2E Investments

1. Axie Infinity (AXS) – The Double-Edged Sword

Overview:

Despite early success, Axie Infinity's economy faced major challenges in 2022.

Challenges:

Unsustainable Tokenomics: Over-reliance on new players to sustain earnings led to economic collapse.

Hyperinflation of SLP: Unlimited minting caused SLP’s value to plummet by over 95%.

Security Breach: The Ronin Network hack in March 2022 resulted in a $620 million loss.

Investment Impact:

AXS dropped from its peak of ~$165 to below $10 in 2022.

Player earnings became negligible, causing user attrition.

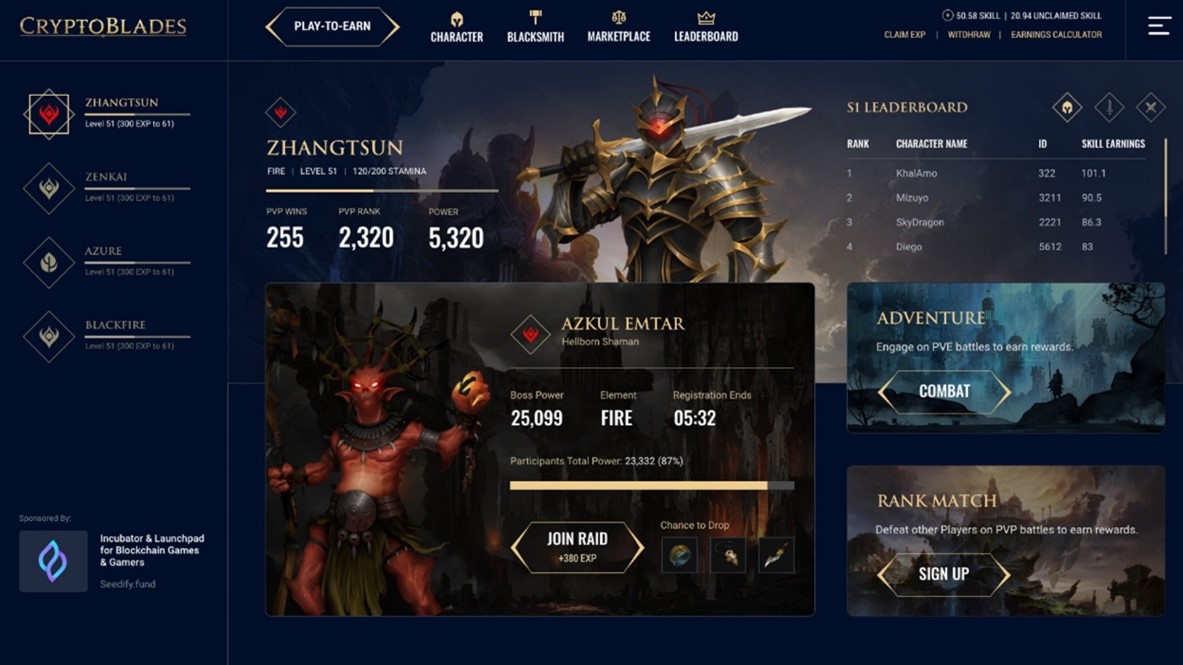

2. CryptoBlades (SKILL) – Rapid Rise and Fall

Overview:

CryptoBlades was a P2E RPG that gained popularity in mid-2021. Players earned SKILL tokens by battling and crafting weapons.

Challenges:

High Entry Costs: Rising fees priced out new players, halting user growth.

Token Dumping: Early investors dumped SKILL tokens, causing a price crash.

Lack of Gameplay Depth: Repetitive mechanics led to poor player retention.

Investment Impact:

SKILL soared to ~$180 in July 2021 but crashed below $5 within months.

Lesson:

P2E games must balance entry costs, token supply, and engaging gameplay to avoid unsustainable spikes and crashes.

Conclusion

Investing in P2E tokens and assets offers both lucrative opportunities and substantial risks. The most successful projects combine strong teams, sustainable economies, and engaging gameplay. In contrast, poorly structured, speculative, or mismanaged projects can result in devastating losses. Conducting thorough due diligence and focusing on long-term sustainability over short-term hype are key to navigating this volatile but promising sector.