Risks and rewards of investing in P2E tokens or assets

Risks and rewards of investing in P2E tokens or assets

by Maximilian 04:59pm Jan 14, 2025

Investing in Play-to-Earn (P2E) tokens or assets can offer significant opportunities, but it also comes with inherent risks due to the speculative nature of the space, market volatility, and evolving regulatory landscape. Here's a breakdown of the risks and rewards associated with such investments:

Rewards of Investing in P2E Tokens or Assets

1. High Growth Potential

Emerging Market: The P2E sector is part of the rapidly expanding blockchain and gaming industries, offering early investors the chance for significant capital appreciation.

Token Price Appreciation: Successful games can drive up demand for in-game tokens and NFTs, leading to substantial price increases.

2. Passive Income Opportunities

Staking and Yield Farming: Some P2E tokens offer staking rewards or yield farming, providing passive income.

NFT Leasing/Renting: In-game NFTs (characters, weapons, land) can be rented to other players for consistent income without active participation.

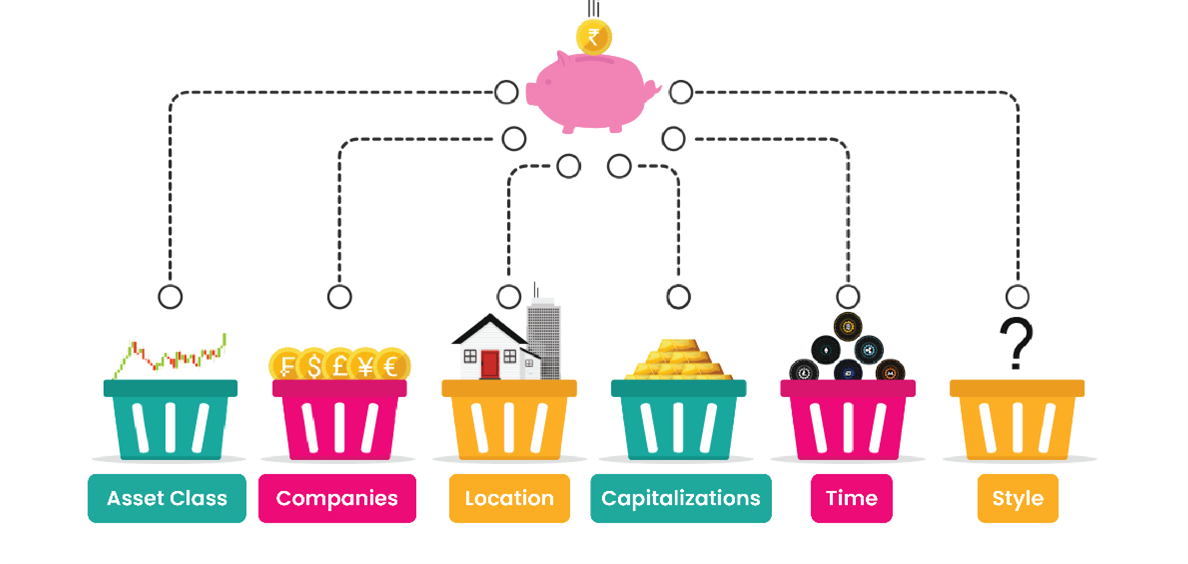

3. Diversification of Investment Portfolio

Exposure to Multiple Sectors: P2E investments offer exposure to gaming, blockchain, DeFi, and NFTs, diversifying traditional and crypto portfolios.

Cross-Industry Integration: P2E games intersect with industries like esports, fashion, and entertainment, expanding revenue streams.

4. Ownership and Control of Digital Assets

True Asset Ownership: NFTs grant verifiable ownership of in-game assets, allowing free trading, selling, or holding for value appreciation.

Interoperability: Some P2E assets are usable across multiple games or metaverse platforms, increasing their utility and value.

5. Community-Driven Growth

Strong Player Engagement: Games with active communities can achieve organic growth, increasing asset demand.

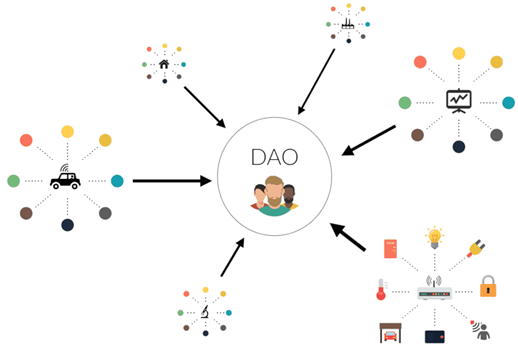

Decentralized Governance (DAOs): Investors can influence game development and ecosystem changes through governance tokens.

6. First-Mover Advantage

Early Access to Innovation: Early investments in promising P2E projects can yield high returns as the market matures.

Venture Capital Entry Point: Retail investors can access growth opportunities similar to early-stage venture capital funding.

Risks of Investing in P2E Tokens or Assets

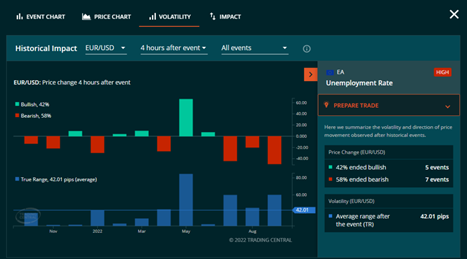

1. Market Volatility

Token Price Fluctuations: P2E tokens are often highly volatile, influenced by crypto market trends, player activity, and speculative hype.

NFT Illiquidity: NFTs can be hard to sell in bear markets or when demand for a game declines.

2. Unsustainable Economic Models

Ponzi-like Structures: Some P2E games rely on constant new player inflows to sustain payouts, risking collapse if growth stalls.

Token Inflation: Excessive token minting or poorly managed economies can devalue in-game currencies.

3. Regulatory Uncertainty

Legal Risks: Governments may regulate or ban P2E models due to concerns over gambling, securities laws, or financial crimes.

Taxation Complexity: Varying tax treatments for crypto earnings and NFTs can impact profitability.

4. Security Vulnerabilities

Smart Contract Exploits: Hacks and vulnerabilities in smart contracts can lead to asset theft or token devaluation.

Phishing and Scams: P2E communities are frequent targets for scams, risking personal asset loss.

5. Project Viability Risks

Unproven Teams: Many P2E projects are built by inexperienced teams or anonymous developers, increasing the risk of failure.

Rug Pulls and Exit Scams: Developers may abandon projects after raising funds, leaving investors with worthless assets.

6. Market Saturation and Competition

Overcrowded Market: The rapid rise of P2E games has led to market saturation, making it difficult to identify sustainable projects.

Short Game Lifecycles: Many games lose popularity quickly, leading to declining player engagement and asset values.

Balancing Risks and Rewards

To mitigate the risks associated with investing in P2E tokens and assets:

Do Thorough Research: Understand the game’s mechanics, team, economy, and tokenomics before making any investments. Look for transparency and credibility.

Diversify Your Investments: Don’t put all your funds into one game or asset. Diversify across multiple P2E projects to spread out risk.

Stay Updated on Regulatory Changes: Keep track of any legal or regulatory changes that might affect the market.

Engage with Communities: Communities around P2E games can offer valuable insights. Active communities may signal that the game is well-received and has long-term potential.

Risk Management: Only invest funds you are willing to lose. P2E assets are speculative and high-risk, so set clear exit strategies and risk management limits.

Conclusion

Investing in P2E tokens or assets can offer attractive rewards, including high returns, true ownership of digital assets, and exposure to innovative technology. However, investors must weigh these rewards against significant risks such as market volatility, game failure, security threats, and regulatory uncertainty. A thoughtful, cautious approach—combined with thorough research and diversification—can help mitigate some of the inherent risks while maximizing potential rewards.