The economics of running a P2E game

The economics of running a P2E game

by Maximilian 03:57pm Jan 15, 2025

Running a Play-to-Earn (P2E) game involves a complex and dynamic economic model that blends traditional game mechanics with blockchain-based technologies like cryptocurrencies and NFTs. The goal of these games is not just to entertain players but also to allow them to earn real-world value through in-game assets. The economic sustainability of a P2E game requires careful planning of the game’s in-game economy, reward distribution, tokenomics, and the interactions between players and the game’s developers.

Here’s a breakdown of the key economic components involved in running a P2E game:

1. Tokenomics and In-Game Currency

Tokenomics is the design of the game’s cryptocurrency or in-game token economy. This is central to the financial structure of a P2E game.

Key Elements:

Utility Token: Most P2E games issue their own native utility token (often an ERC-20 token on Ethereum or a similar blockchain). This token is used to buy in-game assets, pay for fees, and earn rewards. The value of this token is often tied to the game’s ecosystem and player demand.

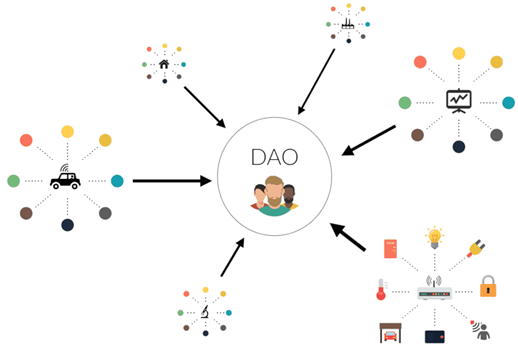

Governance Token: In some games, a governance token is also issued, allowing players to participate in decision-making processes related to the game (e.g., proposing changes to game mechanics or how funds should be allocated).

Burn Mechanisms: To maintain scarcity and potentially increase the value of the token, many P2E games implement “burn” mechanisms, where a portion of the tokens used in transactions (e.g., buying or selling assets) is permanently destroyed or removed from circulation.

2. In-Game Economy Design

Designing the in-game economy is critical for ensuring that the P2E game remains sustainable and enjoyable for players, while also generating revenue for developers.

Key Considerations:

Earning Mechanics: Players earn in-game rewards, such as tokens or NFTs, by engaging with the game (e.g., completing tasks, winning battles, or leveling up). These rewards need to be valuable enough to incentivize participation without being overly inflated. Developers must determine:

How much players can earn and how often

How earnings balance with in-game expenses (e.g., gas fees for blockchain transactions, upgrades, or purchases)

Asset Creation and Ownership: Players may create or acquire unique in-game items (NFTs) that they can sell or trade. The value of these items depends on factors like rarity, utility, and demand within the game or secondary markets. Developers need to ensure that there is enough demand for these items and that they are not easily devalued by oversupply.

Staking and Investment: Some games incentivize players to stake tokens or invest in in-game assets for long-term rewards. This creates an additional layer of economy where players can earn passive income by locking up their tokens for a set period, helping to stabilize the in-game economy.

Liquidity: For a P2E game to maintain a healthy economy, there must be liquidity in the game’s marketplace. If players can’t easily exchange in-game tokens or NFTs for other assets or fiat currency, they may become disillusioned with the game. Therefore, developers need to establish partnerships with cryptocurrency exchanges or create internal markets where players can trade assets.

3. Economic Sustainability

To ensure that the game remains economically viable in the long term, developers must carefully manage the flow of tokens, NFTs, and rewards within the game. Key factors include:

Balancing Rewards and Costs:

Reward Balance: The reward system in a P2E game must strike a balance between rewarding players and maintaining the long-term value of in-game assets. Too many rewards can lead to inflation, where the game’s economy becomes devalued. Conversely, too few rewards can discourage players from engaging with the game.

Player Retention: For the game’s economy to remain sustainable, developers need to keep players engaged. This could involve introducing new content, expanding the game’s narrative, or offering regular updates that provide players with new ways to earn and spend their tokens or NFTs.

Token Burn Mechanisms: Many P2E games implement burn mechanisms to control inflation by removing a portion of tokens from circulation. This can be achieved through transaction fees, special events, or direct token burn initiatives that help reduce the overall supply, theoretically increasing the value of the remaining tokens.

Economic Simulation and Modeling: Some developers use advanced economic modeling and simulation tools to predict the effects of various changes to the game’s economy. By tweaking factors like token issuance rates, reward structures, and transaction fees, developers can refine their game’s economy to ensure it remains balanced.

4. Secondary Market and Liquidity

NFT Marketplaces: Many P2E games allow players to trade NFTs on secondary markets (such as OpenSea or Rarible). Developers may earn revenue from marketplace fees and must ensure that their in-game assets have demand on these platforms to maintain liquidity.

Liquidity Pools and Staking: Some games create liquidity pools or allow players to stake tokens, providing liquidity for the game’s marketplace. These pools can incentivize players to lock up their tokens in exchange for rewards, which helps stabilize the price of in-game tokens and encourages long-term engagement.

5. External Economic Factors

Cryptocurrency Market Volatility: The broader cryptocurrency market can have a significant impact on the P2E economy. If the value of a game’s native token or cryptocurrency experiences significant volatility, it can affect the purchasing power of players and the overall economy of the game.

Regulatory Environment: As governments around the world introduce more regulation in the cryptocurrency space, the legal landscape could affect how P2E games operate. Compliance with anti-money laundering (AML), know-your-customer (KYC), and tax regulations can introduce additional costs and complexities for developers.

Environmental Impact: Blockchain games that rely on energy-intensive consensus mechanisms (such as Proof of Work) may face criticism from environmental groups, and regulatory pressures may arise to reduce their carbon footprint. Games may need to explore more sustainable blockchain solutions (such as Proof of Stake) to remain compliant with environmental regulations.

Conclusion

The economics of running a Play-to-Earn (P2E) game is multifaceted and requires developers to carefully design tokenomics, manage in-game economies, and establish multiple revenue streams. Developers must balance rewarding players with maintaining the long-term sustainability of the game’s economy. They also need to account for external factors such as cryptocurrency market volatility, regulatory changes, and environmental concerns.

For P2E games to succeed and remain viable over time, developers must be adept at creating a well-balanced and sustainable economic model that fosters engagement, incentivizes players, and ensures that the game’s ecosystem remains profitable and resilient.