Financial risks associated with volatile token economies

Financial risks associated with volatile token economies

by Maximilian 02:54pm Jan 20, 2025

The volatile nature of token economies in blockchain gaming, and in broader cryptocurrency markets, presents several financial risks to participants, including players, investors, developers, and even platform operators. These risks can have a significant impact on the value of digital assets, the sustainability of games, and the economic viability of entire ecosystems. Below are the key financial risks associated with volatile token economies:

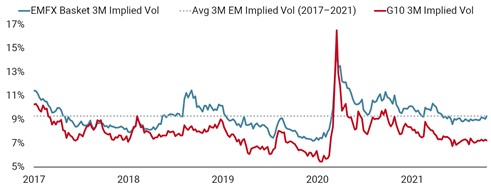

1. Market Volatility and Token Price Fluctuations

Price Instability: Tokens used in Play-to-Earn (P2E) games or DeFi platforms are often highly volatile, meaning their value can fluctuate wildly within short periods. This creates a risk for players who rely on the tokens as a source of income, as the value of their in-game assets or rewards can suddenly drop, potentially leading to financial losses.

Speculative Nature: The token's value is often driven by speculative trading and sentiment rather than underlying utility or fundamentals, which can lead to unpredictable price movements, making it difficult for players to plan their earnings or investments.

2. Illiquidity and Difficulty in Converting Tokens to Fiat

Conversion Challenges: Players and investors in blockchain games may have difficulty converting their tokens or NFTs into fiat currency (local currencies like USD, EUR, etc.), especially if the token's value has dropped or the market is thin (not enough buyers or sellers). In some cases, tokens may not be easily tradable in certain regions or on certain platforms, resulting in illiquidity.

Excessive Transaction Fees: Converting tokens to fiat can incur significant transaction fees, especially during times of network congestion or when using exchanges with high withdrawal fees. These fees can erode profits and make the process less economically viable.

3. Risk of Token Devaluation and Inflation

Over-Supply of Tokens: Many games or projects inflate the supply of their native tokens in order to reward players or incentivize network participants. If the token supply outpaces demand, this can lead to inflation, causing the token’s value to decrease significantly over time.

Loss of Confidence: If the token's value continues to fall or becomes too volatile, players or investors might lose confidence in the game’s economy, further driving down the token’s value and reducing its utility within the ecosystem.

4. Impact of Market Manipulation

Whale Activity: In smaller token economies or emerging markets, large holders of a particular token (referred to as "whales") can manipulate the market by selling large amounts of tokens or buying them in bulk. This can lead to price manipulation and unfair market conditions for smaller players or investors.

Pump and Dump Schemes: Certain tokens, particularly those linked to speculative projects or short-lived games, may become targets for pump-and-dump schemes. In these cases, the price is artificially inflated through coordinated buying before being rapidly sold off, leaving investors with worthless assets.

5. Project or Platform Failure

Game or Platform Shutdown: In the highly experimental world of blockchain gaming, there is a risk that a game or platform may fail due to poor management, unsustainable tokenomics, or a lack of user interest. This could lead to a total loss of value for players who have invested in tokens, NFTs, or in-game assets.

Smart Contract Vulnerabilities: If a game’s smart contracts are poorly written or contain bugs, it could lead to a loss of user funds or assets. Hackers may also exploit vulnerabilities in smart contracts, stealing tokens or NFTs, which further jeopardizes the financial stability of the platform and its participants.

6. Regulatory Risks and Legal Uncertainty

Legal Status of Tokens: In many jurisdictions, the regulatory status of cryptocurrencies and tokens is unclear or in flux. Governments may impose restrictions or classify tokens as securities, which could affect how they are traded or used in gaming environments.

Sudden Regulatory Changes: The imposition of new regulations can make certain tokens illegal to trade or hold in certain regions, causing token prices to plummet. Developers may also be forced to shut down games or refund players if they fail to comply with local laws.

7. Loss of Asset Value Through Speculation

NFT Depreciation: Non-fungible tokens (NFTs) used in blockchain games represent unique in-game items, characters, or assets. The value of these NFTs is often driven by demand, scarcity, and speculation, but if the market for a particular game or ecosystem fades, the value of these assets can depreciate significantly.

8. Security Risks and Cyber Threats

Hacking and Theft: Token economies in blockchain gaming are susceptible to hacking and theft, as they involve digital wallets, exchanges, and smart contracts that can be exploited. A security breach can lead to the loss of players' funds or tokens, especially if they store them in insecure wallets or platforms.

Phishing Attacks: Malicious actors may attempt to trick users into revealing private keys or login credentials through phishing attacks. If successful, these attacks can result in stolen tokens or NFTs.

Conclusion

While the token economy in blockchain gaming offers great potential, it is inherently risky due to the volatility of tokens, regulatory uncertainties, and the speculative nature of digital assets. Participants—whether players, developers, or investors—must be aware of these risks and consider diversifying their investments, conducting due diligence on projects, and employing proper security measures to mitigate potential losses. By understanding these risks, participants can better navigate the complex and dynamic world of blockchain gaming and digital assets.