Regulatory hurdles and government perspectives on P2E

Regulatory hurdles and government perspectives on P2E

by Maximilian 03:09pm Jan 20, 2025

Regulatory hurdles and government perspectives on Play-to-Earn (P2E) gaming are complex and evolving as governments worldwide seek to balance innovation with investor protection, consumer safety, and financial stability. The rapidly growing blockchain gaming sector, fueled by cryptocurrencies, Non-Fungible Tokens (NFTs), and decentralized finance (DeFi) models, raises several challenges for regulators. These challenges differ based on the country’s legal environment, financial ecosystem, and approach to blockchain and cryptocurrency regulation. Below, we explore the key regulatory hurdles and government perspectives on P2E gaming.

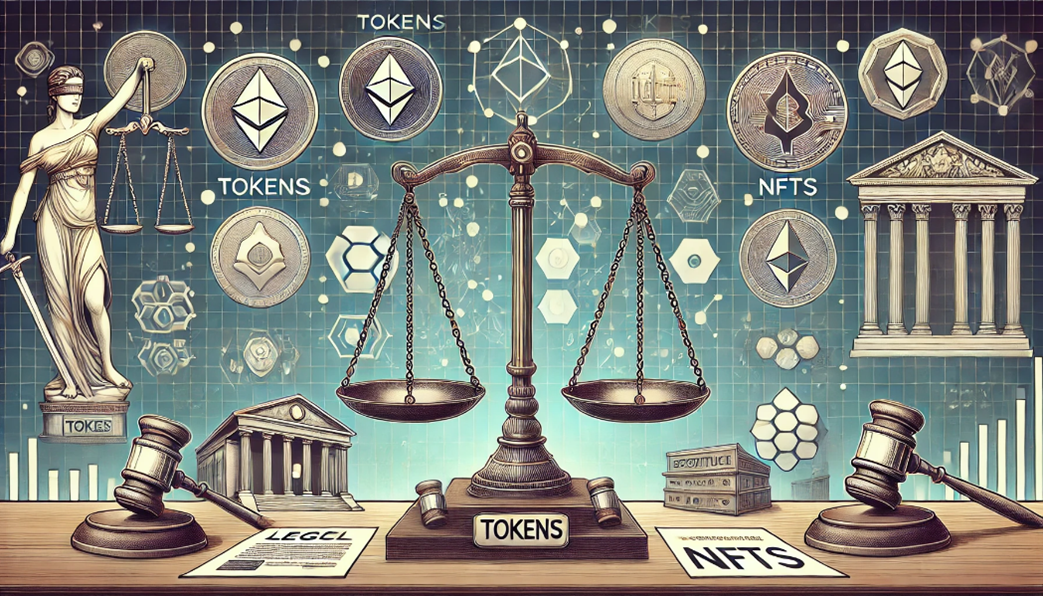

1. Legal Classification of Tokens and NFTs

Cryptocurrency Regulations: Governments are struggling to classify and regulate the cryptocurrencies used within P2E games. Depending on the jurisdiction, cryptocurrencies could be classified as commodities, securities, or currency. The classification affects how they are taxed, traded, and used.

Securities: If a cryptocurrency or token is classified as a security, it may require the game developers to comply with securities laws, including registration, investor protection measures, and disclosures.

Commodities: In some regions, cryptocurrencies might be considered commodities, subject to trading and taxation under commodity regulations.

Currency: Cryptocurrencies used within games might also be viewed as alternative currencies or payment systems, bringing the potential for oversight by financial regulatory bodies.

NFTs and Ownership: The legal status of NFTs in games (digital items representing in-game assets like skins, characters, or land) is also unclear. In some jurisdictions, NFTs might be classified as digital goods, while in others, they might be considered securities if they involve investment-like characteristics (e.g., speculating on their future value).

Ownership Rights: Questions around ownership and transferability of NFTs are common. Governments are considering whether NFTs represent tangible ownership of digital assets and what protections need to be in place for buyers and sellers.

2. Financial Regulations and Anti-Money Laundering (AML)

AML and KYC Requirements: Governments are concerned about the potential use of P2E platforms for money laundering or other illicit activities. Since blockchain transactions can be pseudonymous and cross-border, P2E platforms may be required to comply with Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations, which are designed to prevent illegal activities like money laundering and terrorist financing.

KYC/AML Enforcement: Some countries may mandate that players register with their full identity, and that platforms track user activity to ensure they are not engaged in money laundering or fraud. These requirements could limit the anonymity of blockchain gaming and deter some players from engaging.

Taxation: Many governments are increasingly focused on how P2E gaming impacts tax collection. In P2E games, where players earn tokens that can be traded for real money or converted into fiat currency, regulators are concerned with how to properly tax earnings. Should tokens earned through gaming be considered income? What tax rates should apply? How should NFTs and digital assets be taxed if they are resold for profit? These questions require clear regulatory frameworks.

CapitalGains Tax: Governments may apply capital gains tax on profits made from trading NFTs or cryptocurrencies, adding complexity for players who earn tokens or assets in a game and later sell them at a higher price.

3. Consumer Protection and Fraud Prevention

Investment Risks: P2E games often involve speculative investments, as players can potentially earn large returns, especially in volatile markets. This opens up concerns about consumer protection, particularly for inexperienced players who may fall prey to scams, predatory practices, or unstable game economies.

Ponzi Schemes and Scams: Some P2E games, particularly those with unclear tokenomics or lack of transparency, may attract fraudsters or launch "pump-and-dump" schemes where early investors benefit at the expense of later participants.

Developer Accountability: Governments may require clearer guidelines for developers to ensure they are transparent about risks, including the volatility of tokens, potential for project failure, and realistic earning expectations.

Game Sustainability: Some P2E games have been criticized for having unsustainable economic models, where a constant influx of new players is necessary to maintain rewards for existing players. These “Ponzi-like” models can collapse, leaving late participants with nothing. Regulators may step in to ensure that game economies are sustainable and do not exploit players.

4. Gambling Regulations

P2E as Gambling: In certain countries, governments view any form of gaming with monetary rewards as a form of gambling. If a game’s economy depends on chance (e.g., loot boxes, NFT drops, or random rewards), it might fall under gambling laws, subjecting developers to stricter regulations.

Loot Boxes: Some P2E games include randomized in-game purchases (such as loot boxes or NFT packs), which can resemble gambling mechanics. Many countries have started regulating loot boxes as a form of gambling due to their similarity to betting or gambling activities.

Chance vs. Skill: Games that involve a mix of chance and skill may face additional scrutiny, with governments focusing on whether they should be classified as gambling or skill-based games, especially in regions with strict gambling laws.

5. Intellectual Property (IP) and Copyright Concerns

Game Asset Ownership: In blockchain gaming, players may create or own digital assets (such as NFTs) that have real-world value. Disputes may arise over the ownership of intellectual property rights, particularly when game assets are resold or used outside the game environment. Governments may need to establish rules regarding ownership rights, usage rights, and licensing of NFTs.

Infringement of Copyrights: If players create or sell in-game assets that infringe on copyrighted material, it can lead to legal complications. Ensuring that NFTs and other digital goods within P2E games comply with IP laws is a significant concern.

6. Risks of Centralized Control vs. Decentralized Platforms

Centralized vs. Decentralized Control: Many blockchain games operate on decentralized networks, meaning there is no single entity that controls the platform. Governments may face challenges regulating these decentralized platforms effectively, as they may be harder to track and enforce rules on. On the other hand, centralized platforms that issue their own tokens may face more direct regulatory scrutiny.

Centralized Authority: In regions where the government prefers centralized control, P2E games that are not subject to a central authority may face higher barriers to entry or be prohibited altogether.

Conclusion

Governments are still grappling with how to regulate Play-to-Earn gaming ecosystems, and the legal landscape is evolving rapidly. While P2E games present tremendous opportunities for innovation, financial inclusion, and economic growth, they also pose significant risks related to financial security, consumer protection, and legal compliance. Regulatory clarity is essential for the sustainable growth of blockchain gaming, but governments must strike a balance between enabling innovation and protecting consumers and investors from the potential harms associated with volatile digital economies.